Maximize Your Income Tax Refund

File ITR in Just 5 Minutes By Tax Experts

only at Rs. 699/-

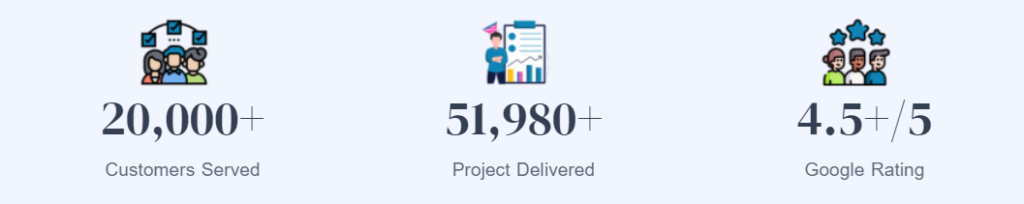

We are Proud of Our Works

Get Instant Quote Free

10.5k+ Happy Reviews

Income Tax Return Filing Online in India

Do you Know? Non-compliance with ITR filing regulations can result in severe penalties and legal consequences. With this properly filed ITRs decrease the chances of being audited or investigated by tax authorities. Hence to protect you from all the hassles we are your reliable online platform for filing your income tax returns in India. Look no further! Legal Pillers is your trusted partner in ensuring a seamless and professional experience for individuals and businesses. Filing your ITR showcases transparency in your financial dealings. This can enhance your credibility and open doors to various financial opportunities. Our platform is dedicated to your specific needs, providing comprehensive services designed to simplify the complex income tax filing process.

Loan Approvals and Financial Transactions

Banks and financial institutions often require ITR documents when considering loan applications ensuring smooth financial interactions.

Avoid Inspection

Properly filed ITRs reduce the likelihood of scrutiny from tax authorities. This shields you from unnecessary audits and investigations.

Online ITR Filing

Our CA Service is designed to make e-filing easier. Whether you're, an individual or a business entity, our interface guides you through the whole process.

Income Tax e-Filing

Stay updated with the latest tax regulations. Our platform is up-to-date with the e-filing requirements for the financial year.

Benefits of Filing Income Tax Online

Claiming Tax Refunds

By filing your income tax return, you may be eligible for a tax refund if you have paid more tax than your actual liability. This can result in a financial windfall.

Financial Responsibility

A filed income tax return serves as documented proof of your financial stability and responsibility.

Avoidance of Penal Consequences

By filing ITR Returns promptly, you can avoid unnecessary financial burdens.

Facilitates Loan Approval

Banks and financial institutions often require income tax returns as part of their assessment process for granting loans.

Supports Financial Planning

Income tax returns contain a record of your income, investments, and deductions. This information is invaluable for planning your finances effectively in the future.

Legal Safeguard

Filing your ITR shows your commitment to fulfilling your civic duty and protects you from Legal conflicts.?

Need Guidance From Tax Expert's

Talk to our experts to kickstart your business registration process.